are charitable raffle tickets tax deductible

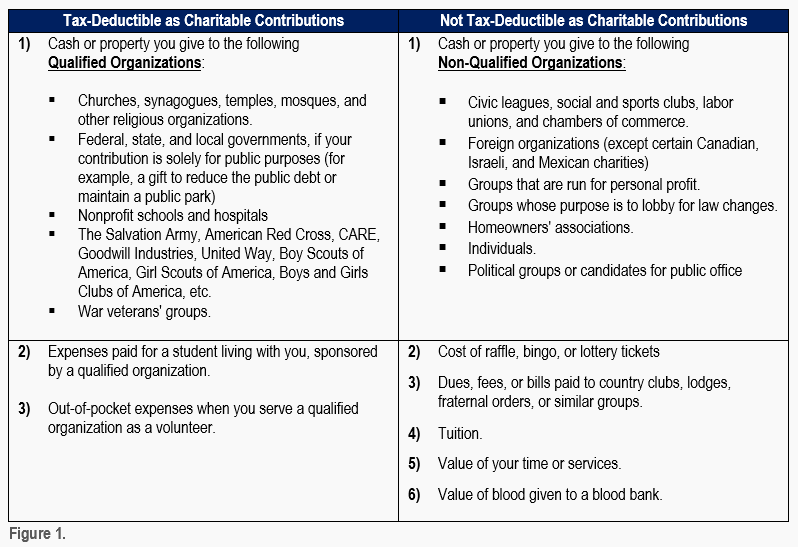

The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. The donor must be able to show however that he or she knew that the value of the item was less than the amount paid.

Ticket Events Set Tax Deductible Amounts Givesignup Blog

However the answer to why raffle tickets are not tax-deductible is quite simple.

. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. On October 31 2004 the. Raffle Tickets even for a charity are not tax-deductible.

To claim a deduction you must have a written record of your donation. You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. The purchase of a raffle ticket is not considered a charitable donation.

Your state may or may not permit charitable nonprofits to conduct raffles Bingo auctions and other games of chance. Withholding Tax on Raffle Prizes Regular Gambling Withholding. If you win the raffle you may even end up owing tax.

Thats averaging out claims by the likes. The IRS regulates games of chance too as well as the taxable income that is earned by victorious game-players. This might sound nonsensical on the surface.

Are raffle tickets for a nonprofit tax-deductible. The IRS has determined that purchasing the chance to win a prize has value that is essentially equal to the cost of the raffle ticket. An organization that pays raffle prizes must withhold 25 from the winnings and report this.

Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization. A gala dinner costs 100 per person for. You cant claim gifts or donations that provide you with a personal benefit such as.

Ad Learn how to give to your favorite charities and maximize tax benefits. Unfortunately fund-raising tickets are not deductible. The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on the same return.

For specific guidance see this article from the Australian Taxation Office. If the organization fails to withhold correctly it is liable for the tax. The language of the law is very technical.

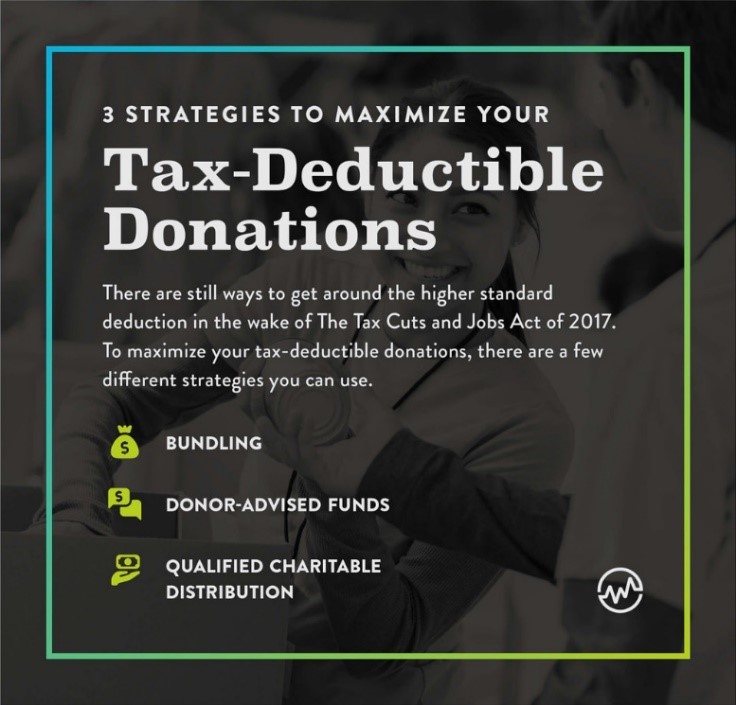

In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending on the type of contribution and the organization contributions to certain private foundations veterans. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Items such as chocolates mugs keyrings hats or toys that have an advertised price.

Buying a ticket lets you help your community but it doesnt help you claim a deduction for a charitable donation. The Charitable Raffle Enabling Act CREA permits qualified organizations to hold up to two raffles per calendar year with certain specified restrictions. The IRS has determined that purchasing the chance to win a prize has value that is essentially equal to the cost of the raffle ticket.

If it does it is likely your nonprofit will need to apply for a license from the state beforehand. The IRS considers a raffle ticket to be a contribution from which you benefit. LANGUAGE FOR TICKET PURCHASE FORM.

How much of a tax break do you get for donating to charity. Raffle or art union tickets for example an RSL Art Union prize home. This is because the purchase of raffle tickets is not a donation ie.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. By chance at a single occasion among a single pool or group of persons who have paid or promised a thing of value for a ticket that.

For example a charity may publish. How much of a charity event ticket is tax-deductible. Costs of raffles bingo lottery etc.

Exceptions for Charity Raffle Donations. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

There is the chance of winning a prize. Also if the amount of your contribution depends on the type or size of apartment you will occupy it isnt a charitable contribution. What you cant claim.

The IRS classes money spent on raffles and lotteries as contributions from which you benefit and therefore it is generally not deductible. Schwab Charitable makes charitable giving simple efficient. If it does it is likely your nonprofit will need to apply for a license from the state beforehand.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Are Raffle Tickets Tax Deductible The Finances Hub

501c3 Tax Deductible Donation Letter Donation Letter Regarding Business Donation Letter Template Donation Letter Template Donation Letter Letter Templates

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

Are Raffle Tickets Tax Deductible The Finances Hub

Bundling Can Provide Tax Advantages Catholic United Financial

Are Raffle Tickets Tax Deductible The Finances Hub

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Are Nonprofit Raffle Ticket Donations Tax Deductible

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

501c3 Tax Deductible Donation Letter Donation Letter Template Donation Letter Receipt Template

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Explore Our Example Of Silent Auction Donation Receipt Template Silent Auction Donations Receipt Template Auction Donations

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Charitable Donation Receipts Requirements As Supporting Documents For Tax Deductible Donations Donation Letter Donation Letter Template Donation Form

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

Comments

Post a Comment